Suebelle Robbins Net Worth: Not Available (Likely a Private Individual)

Suebelle Robbins Net Worth: Not Available (Likely a Private Individual) remains a figure shrouded in financial ambiguity. Her net worth is not publicly available, likely due to her preference for privacy as an entrepreneur. This lack of transparency raises questions about the true nature of her financial status. Speculation often fills the void left by absent public records. Understanding her approach to personal finance may provide insights into broader themes of wealth management and the significance of discretion in financial matters.

Background on Suebelle Robbins

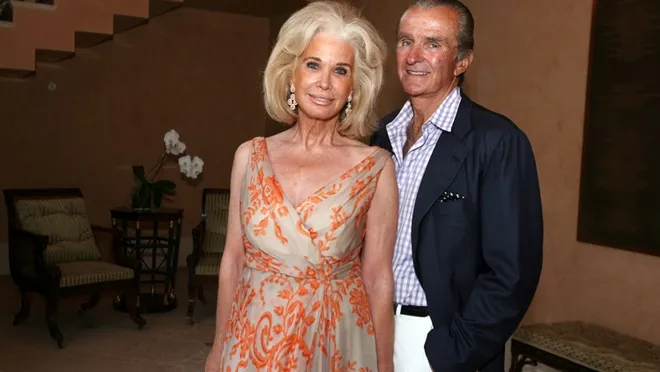

Suebelle Robbins Net Worth: Not Available (Likely a Private Individual), a prominent figure in her field, has garnered attention for her innovative contributions and entrepreneurial endeavors.

Her personal history reflects a journey marked by resilience and ambition, shaping her public persona as a dynamic leader.

Robbins navigates the complexities of her industry with a commitment to authenticity, appealing to those who value independence and the pursuit of individual freedom in their financial aspirations.

The Importance of Privacy in Personal Finance

Financial privacy is a critical aspect of personal finance that safeguards individuals from potential risks associated with public disclosure.

Protecting personal information helps to mitigate threats such as identity theft and financial exploitation.

The consequences of failing to maintain this privacy can be severe, leading to reputational damage and financial loss.

Value of Financial Privacy

Privacy serves as a cornerstone of personal finance, influencing not only individual decisions but also the broader economic landscape.

By safeguarding personal financial information, individuals cultivate sound financial habits and make informed choices without external pressure.

The privacy benefits extend beyond mere confidentiality, fostering an environment where individuals can explore financial opportunities freely, thus promoting autonomy and encouraging responsible financial behaviors.

Protecting Personal Information

Although many individuals may underestimate its significance, protecting personal information is essential in personal finance management. A strong focus on privacy helps maintain personal boundaries and minimizes one’s digital footprint.

Key aspects include:

- Regularly updating passwords

- Utilizing two-factor authentication

- Limiting information shared online

- Monitoring financial accounts

- Educating oneself about data privacy

These measures contribute to safeguarding financial security and personal autonomy.

Consequences of Public Disclosure

When individuals fail to safeguard their personal information, they expose themselves to various adverse consequences that can significantly impact their financial well-being.

Public scrutiny can lead to unwanted attention, potentially compromising personal boundaries. This exposure may result in identity theft, financial fraud, or reputational damage, underscoring the critical need for privacy in personal finance to protect against these vulnerabilities and maintain autonomy.

Speculations Surrounding Suebelle Robbins’ Financial Status

As speculation continues to swirl around Suebelle Robbins’ financial status, various sources have attempted to estimate her net worth, often leading to conflicting reports.

These speculative estimates are complicated by privacy concerns surrounding her personal life.

Key points of contention include:

- Lack of public records

- Discrepancies in reported assets

- Variability in income sources

- Influence of media narratives

- Impact of personal choices on wealth

The Impact of Public Perception on Wealth

How does public perception shape the understanding of an individual’s wealth?

Public perception acts as a lens through which wealth is evaluated, often amplifying wealth disparity. Individuals may be judged based on appearances or social status, leading to assumptions that may not reflect reality.

This dynamic can influence opportunities and relationships, revealing the complexities of wealth beyond mere financial metrics.

Understanding the Value of Financial Discretion

Financial discretion plays a crucial role in maintaining an individual’s privacy and reputation, particularly for those in the public eye.

By strategically managing financial information, individuals can enhance their financial security and mitigate risks associated with public scrutiny.

Understanding these dynamics is essential for navigating the complexities of wealth and its perception in society.

Importance of Privacy

Privacy serves as a crucial element in the realm of personal finance, allowing individuals to navigate their financial landscapes with discretion and security.

Respecting personal boundaries and privacy rights fosters a sense of autonomy and control.

Key aspects include:

- Protection from unwanted scrutiny

- Enhanced decision-making capabilities

- Preservation of personal autonomy

- Mitigation of financial risks

- Promotion of trust in financial relationships

Impact on Reputation

While individuals manage their finances, the impact on reputation often hinges on their ability to maintain discretion. Reputation management becomes essential in mitigating public scrutiny, where financial transparency can lead to both trust and skepticism. Thus, strategic privacy ensures a favorable public image.

| Aspect | Importance | Impact on Reputation |

|---|---|---|

| Financial Privacy | Protects personal life | Reduces public scrutiny |

| Discretion in Wealth | Enhances trust | Maintains positive image |

| Transparency vs. Privacy | Balancing act | Influences public perception |

Financial Security Strategies

Effective financial security strategies hinge on the prudent management of one’s wealth and the deliberate choice of discretion. Individuals seeking financial independence often employ various investment strategies to safeguard their assets.

Key considerations include:

- Diversification of assets

- Regular financial reviews

- Establishing emergency funds

- Utilizing tax-efficient investments

- Setting clear financial goals

These practices enhance security while promoting a sense of freedom in financial decision-making.

Lessons on Wealth Management From Private Individuals

Wealth management lessons from private individuals often reveal practical strategies that are applicable across various financial landscapes.

Key insights include the importance of wealth preservation through diversified asset allocation. By balancing risk and return, individuals can create a robust portfolio that withstands market fluctuations.

These principles emphasize a disciplined approach, encouraging individuals to prioritize long-term stability and financial independence in their wealth management practices.

Read more: Steve Cochran Net Worth: $5 Million (At the Time of Death)

Conclusion

In the grand theater of wealth, where figures dance under the spotlight of public scrutiny, Suebelle Robbins Net Worth: Not Available (Likely a Private Individual) remains an enigmatic shadow, expertly navigating the labyrinth of financial discretion. Her choice to eschew visibility transforms her net worth into an elusive specter, challenging the notion that wealth is merely a numeric value. This deliberate obscurity serves as a powerful reminder that true financial management is not about flaunting riches but rather about safeguarding one’s legacy amidst the cacophony of speculation.